Surety Bonds in the Age of AI: What Bonding Professionals and Business Owners Think

Technology is changing how many industries work, and the surety bond market is no exception. With artificial intelligence (AI), automation, and digital tools now influencing underwriting, the question is no longer if the industry will modernize, but how quickly.

To find out, we surveyed over 500 bonding professionals and small business owners to understand whether these changes are improving workflows or creating new barriers. Here's what they revealed about the future of surety bonds in a digital world.

Key Takeaways

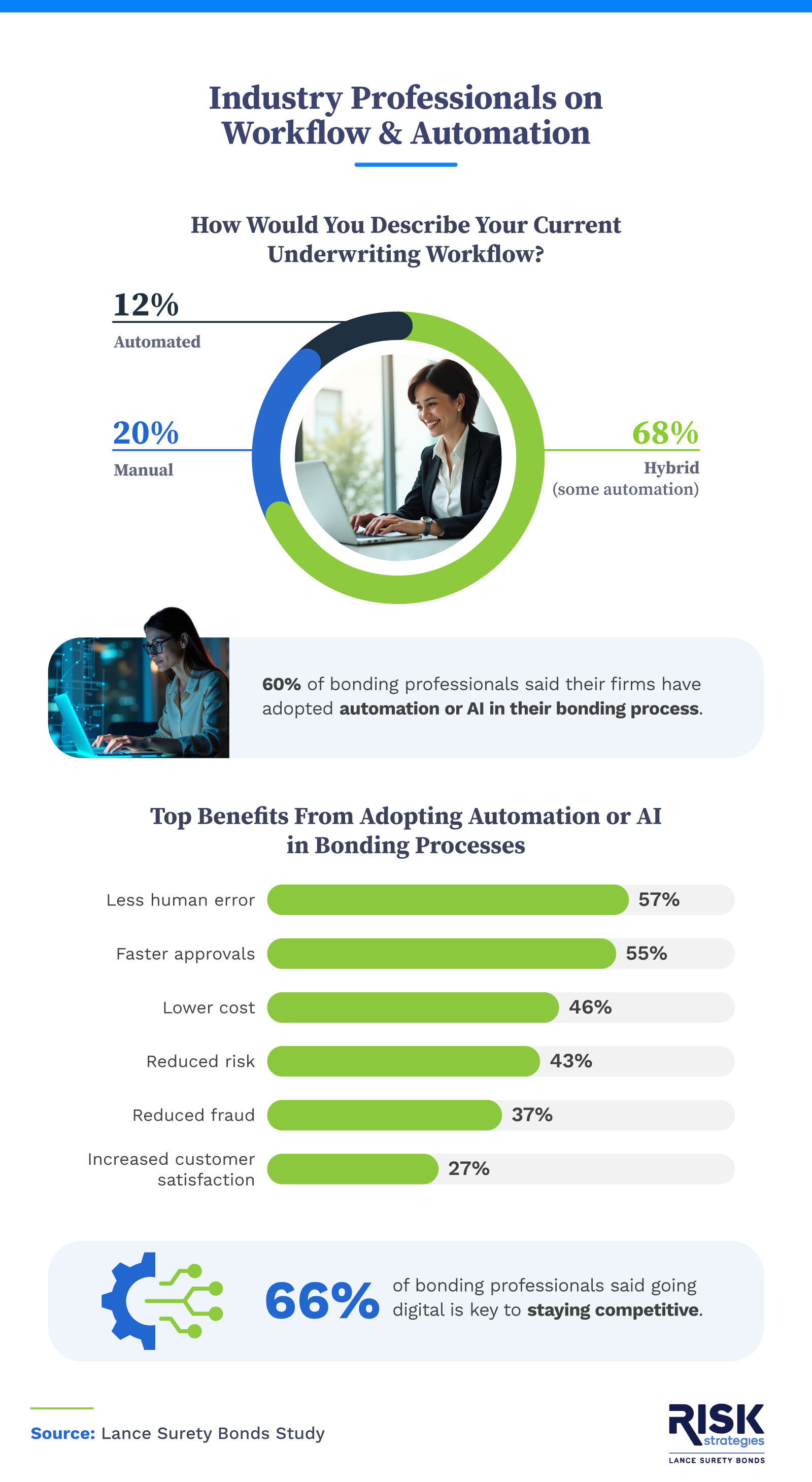

- 60% of bonding professionals have implemented AI or automation in the bonding process, while 1 in 5 say their work is still mostly manual.

- 59% of bonding professionals say outdated workflows like paper or fax are costing their firms money and efficiency.

- 43% of bonding professionals trust AI tools to be more accurate than traditional models.

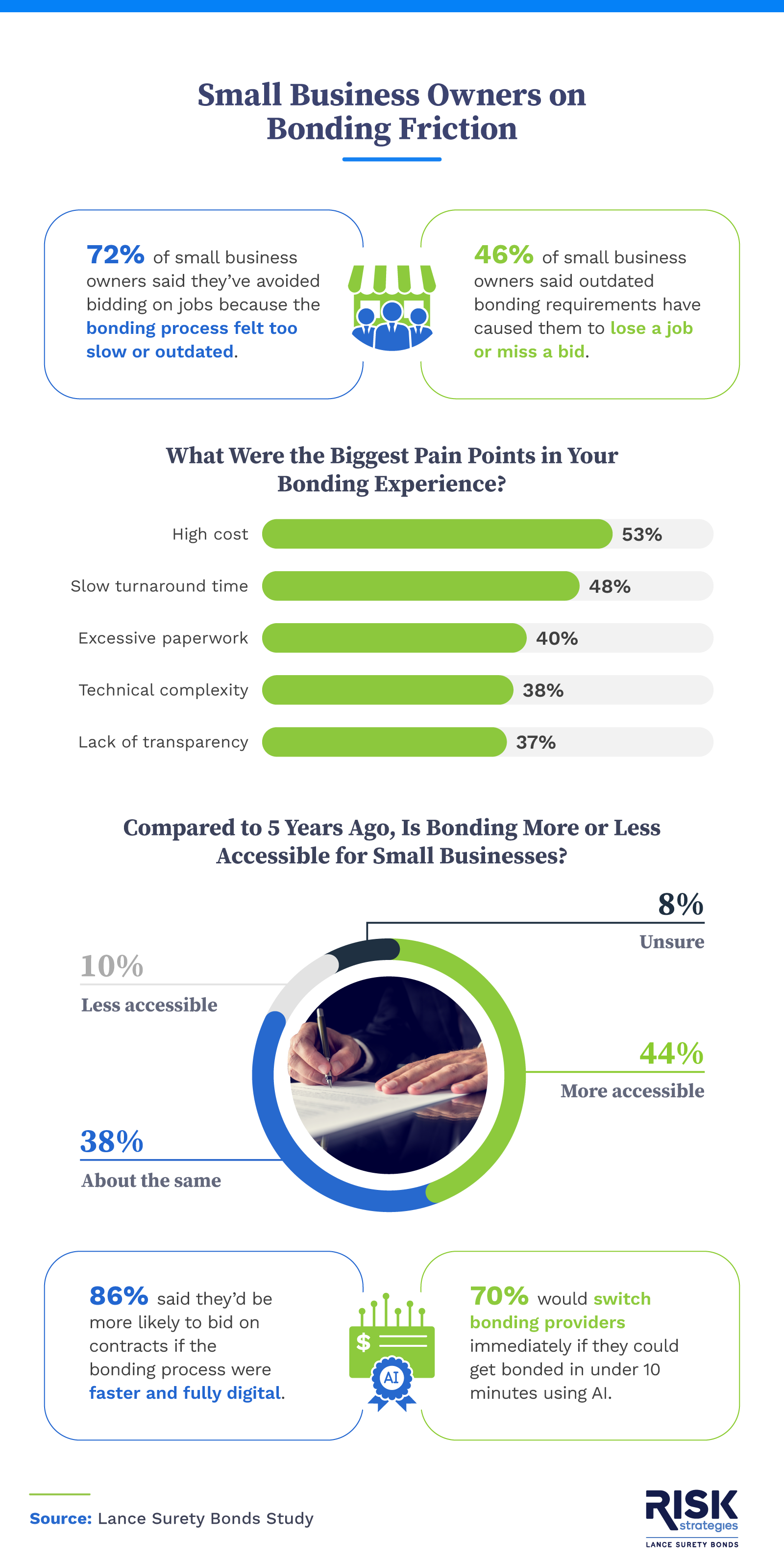

- 46% of small business owners say outdated bonding requirements have caused them to lose a job or miss a bid.

- 72% of small business owners say they've avoided bidding on jobs because the bonding process felt too slow or outdated.

- 70% of small business owners would switch bonding providers immediately if they could get bonded in under 10 minutes when using AI.

Get Your Free Bond Quote Today. 100% Secure and No Obligation!

Is the Bonding Industry Ready To Automate?

Even as digital tools enter the bonding space, many professionals remain split on how fast and how fully the industry should evolve.

More than half of bonding professionals (60%) said they've already adopted AI or automation in their work, but 20% were still handling processes manually. This gap shows an uneven pace of adoption, especially as 56% noted that their clients increasingly expect a digital-first experience.

Efficiency is also a growing concern. Nearly 3 in 5 bonding professionals reported that outdated workflows, such as paper forms or faxed documents, are hurting both productivity and profitability. Half of those surveyed admitted they feel pressured to modernize, either due to competition from insurtech firms or internal bottlenecks.

Despite growing adoption, many professionals voiced concerns about automation. The top issues included potential job loss or role reduction for underwriters (41%), overreliance on algorithms (40%), and the possibility of errors without accountability (40%). Other concerns included a lack of transparency in AI decisions (35%), damage to client trust (29%), and bias in decision-making (26%).

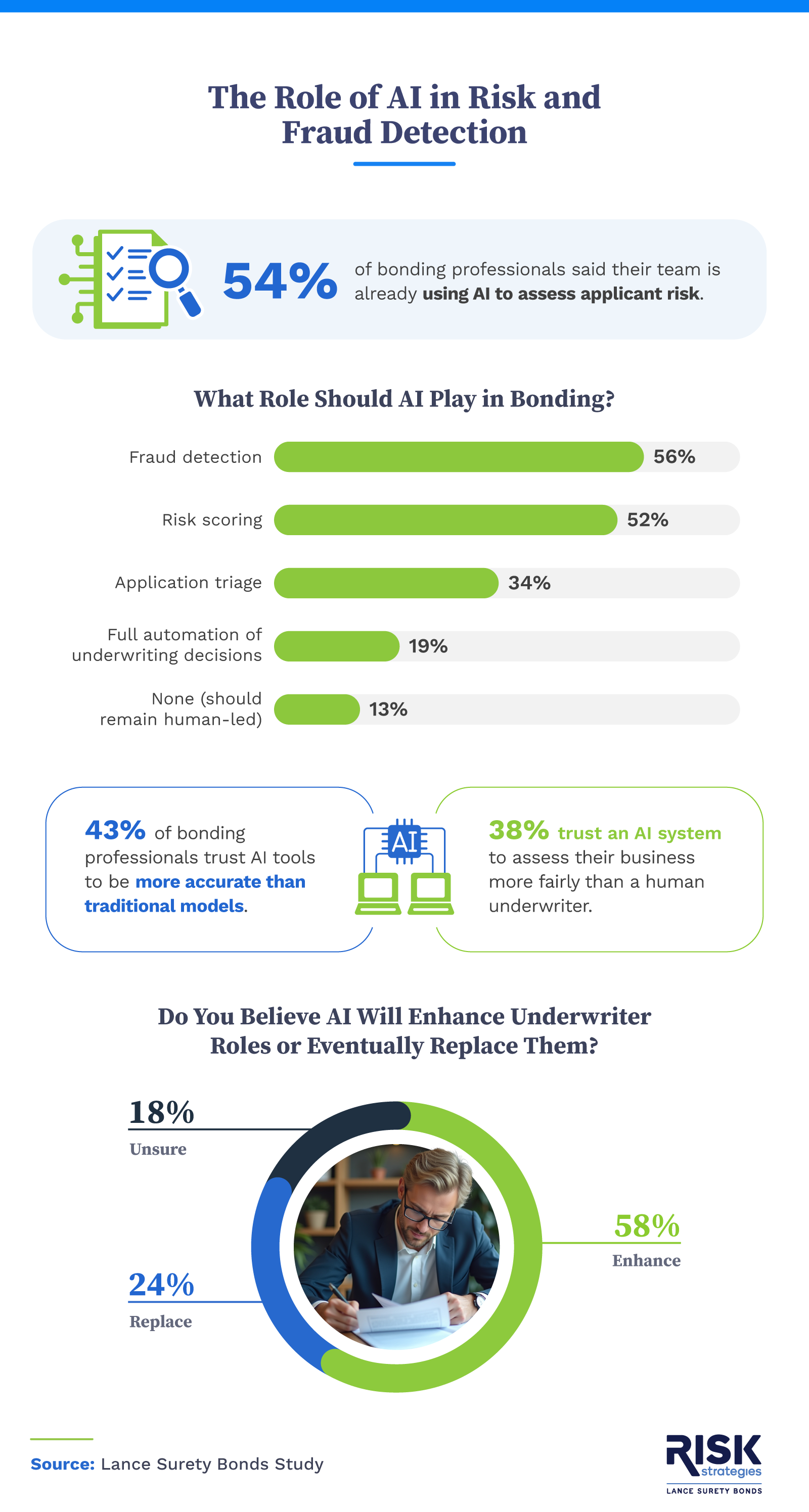

Can AI Be Trusted To Assess Bonding Risk?

As digital tools take on more decision-making responsibility, trust in their accuracy and security becomes a central issue.

Over half of bonding professionals (54%) said their teams are already using AI to assess applicant risk. And 43% trust these tools to outperform traditional risk models, a promising sign of confidence in tech-enabled underwriting.

Still, challenges remain. Thirty percent of bonding professionals noted an increase in attempted fraud over the past year, raising the stakes for any automated system. So, while AI may improve efficiency and precision, firms must also invest in safeguards to detect manipulation and ensure fairness in the process.

Is the Bonding Process Costing Small Businesses Opportunities?

For small business owners, slow or outdated bonding processes aren't just a nuisance. They're a serious barrier to growth.

Old-fashioned bonding requirements had caused 46% of small business owners to lose a job or miss out on a bid. More than 7 in 10 admitted they've avoided bidding altogether because the bonding process felt too slow or complicated.

When asked how they'd respond to a faster, AI-powered option, 70% said they would switch providers immediately if it meant getting bonded in under 10 minutes. The demand for speed and simplicity is clear.

Importantly, small business owners also showed trust in these technologies. The majority (78%) believed AI could help make bonding more accessible to companies like theirs, and 63% trusted an AI-based system to evaluate their business fairly.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

A Bonding Industry at a Crossroads

Our research shows an industry facing rapid change. Automation appears no longer optional, but essential to meet modern demands. Bonding professionals recognize the benefits and risks of AI adoption, while small business owners are eager for faster, more accessible solutions. As the market evolves, those who embrace digital transformation with transparency and care will be best positioned to lead.

Methodology

We surveyed 544 employed Americans working in roles related to surety bonding and risk management to explore how digital tools, AI, and automation are affecting underwriting practices. Of those surveyed, 68% were bonding professionals, and 32% were small business owners with bonding experience. The data was collected in June 2025.

About Lance Surety Bonds

Lance Surety Bonds is a trusted provider of surety bonds for professionals, contractors, and small businesses across the United States. Whether you need a license bond, contract bond, or commercial bond, our team makes the process fast and simple, helping you stay compliant and competitive in a changing market.

Fair Use Statement

If you'd like to share or reference this data, you're welcome to do so for noncommercial purposes. Just be sure to link back to this page and credit Lance Surety Bonds appropriately.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.