Surety Strategies for 2026: Preparing Your Business for the Next Infrastructure Wave

The 2026 infrastructure cycle will be the single biggest test of contractor financial discipline in more than a decade.

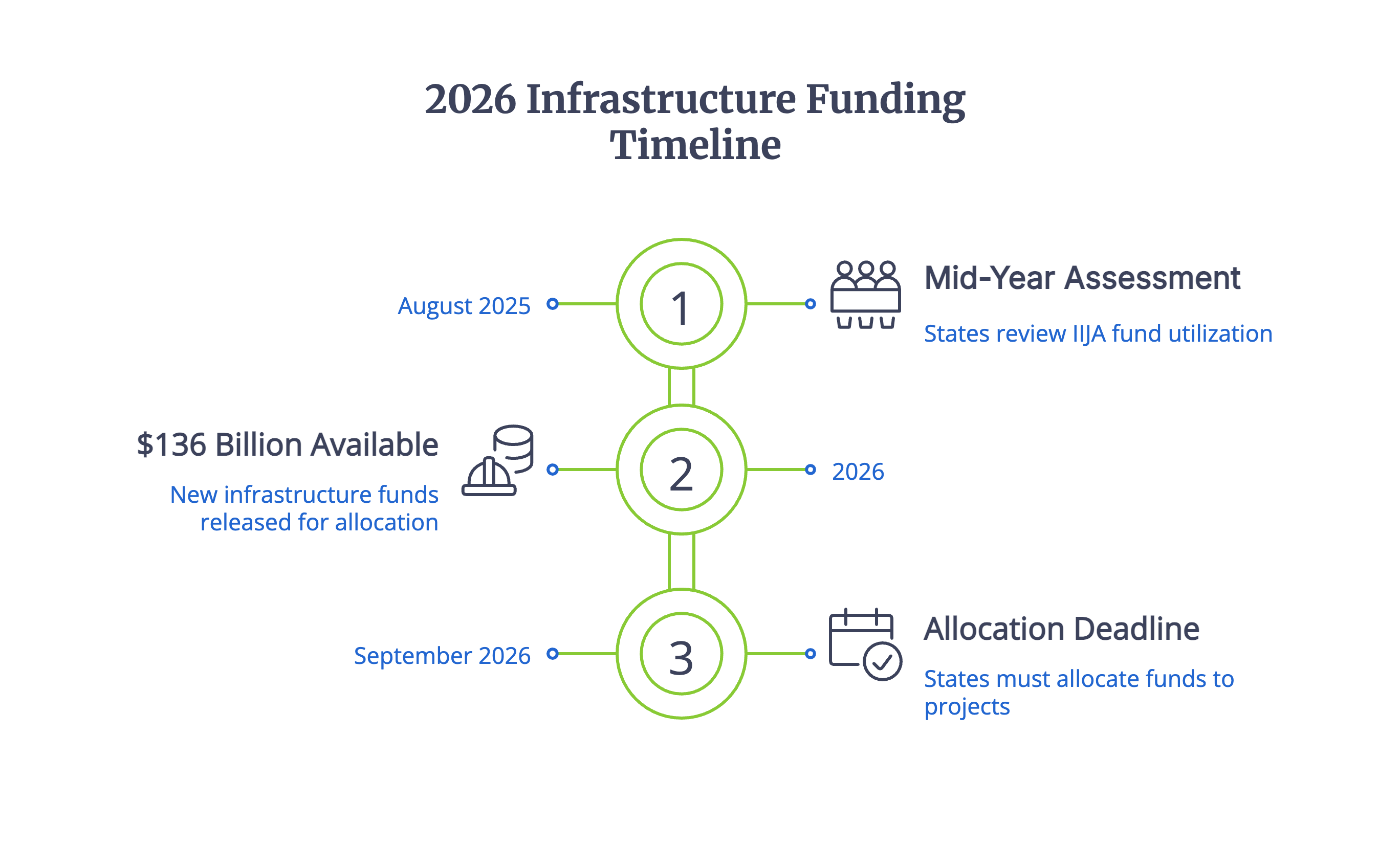

With billions in unspent Infrastructure Investment and Jobs Act (IIJA) funds approaching their final allocation deadline, states will be racing to push projects into motion before September 2026. That last-cycle surge will accelerate project starts across the country, but not evenly. Regions with population growth, labor capacity, and supply chain resilience will move fastest, while others will struggle to deploy their allocations in time.

This uneven project wave will create a more competitive environment for contractors of all sizes, but especially for small and mid-sized firms. Bond capacity will tighten, underwriting reviews will become more rigorous, and pricing will remain firm as carriers work to manage increased risk and expanding backlogs. Contractors who wait until the funding rush hits to evaluate their bonding program may find themselves constrained at the exact moment opportunity peaks.

From a surety perspective, the contractors who will win in 2026 are those who prepare now by strengthening balance sheets, improving liquidity, and engaging early with their surety partners to secure the capacity they’ll need. Based on what I’m seeing across the market, here are the trends that matter most and the steps contractors should be taking today to position themselves ahead of the coming demand.

Expect Higher Bond Demand, with Variation Across Markets

There’s no doubt that the combination of federal infrastructure spending and ongoing private-sector development is going to push more projects into the pipeline—but the effects won’t be uniform. Some regions will feel the surge more than others, depending on labor availability, supply chain pressures, and population growth.

Since IIJA funding was designed to be distributed to states based on population, California ($32.7 billion), Texas ($28 billion) and New York ($23.6 billion) have benefitted the most to date. However Arkansas, Wyoming, Washington, and Oregon have each utilized less than 45% of their allotments as of August 2025.

With another $136 billion available in 2026, and the need to allocate these funds before September, any state that can act proactively to secure project funds is likely to see a surge in new works that could continue through the remainder of the decade.

So, while contractors should prepare for heightened competition and tighter bonding capacity in larger states, in states where spending remains more modest or delayed, the risk–reward profile may differ. An uptick in demand for bid, and performance and payment bonds means you must take time to evaluate where your market fits into that picture during 2026.

For contractors, this means:

- Larger firms will be pursuing more work and more capacity.

- Smaller and mid-sized firms may need to revisit their bonding programs to ensure they can compete.

- Sureties will be paying closer attention to overall contractor readiness, even if rates remain relatively stable.

My recommendation is to take the time this year to reevaluate your bonding strategy. Doing that now—not when bidding activity spikes—will help you avoid capacity bottlenecks and put you in a stronger position when the rush for 2026 projects begins.

Remember that Liquidity and Working Capital Matter

For contractors, liquidity is leverage in the surety space. In a high demand surety market, liquidity and working capital management are the most influential factors in determining how much total bonding capacity you can receive, how large of an individual project a surety will approve, and ultimately, how favorable your surety terms (rates) are.

Strong liquidity tells a surety three important things:

- You can handle larger projects without straining working capital

Infrastructure jobs often involve long pay cycles, retainage, and substantial upfront costs. Coupled with experience in completing jobs near that size, liquidity tells sureties you can float those demands on the financial side.

- You can weather volatility

With labor shortages, material price uncertainty, and scheduling pressures, sureties will favor firms with enough cushion to manage unexpected disruptions.

- You can support a growing backlog

As more work becomes available, contractors with strong working capital are better positioned to take on multiple jobs at once—something sureties examine closely.

That’s why, in 2026, liquidity becomes the differentiator: the firms with healthier balance sheets will simply have access to more opportunities, face fewer bonding restrictions, and move faster when bidding windows tighten.

In practical terms, my advice to contractors is to focus on improving liquidity wherever possible—whether that’s through retaining more earnings, tightening overhead, or maintaining stronger discipline on project management. Every incremental improvement strengthens your working capital position, and that directly impacts the size and number of projects your surety will support.

Factor in More Thorough Underwriting Reviews

My experience tells me that, while there is abundant capacity by surety carriers for surety credit, as backlogs grow and risk spreads, surety carriers are highly likely to tighten underwriting standards. This probably won’t result in increased premiums but it will mean that surety underwriters will dive deeper in their analysis of their contractor accounts.

Carriers will look more closely at several areas:

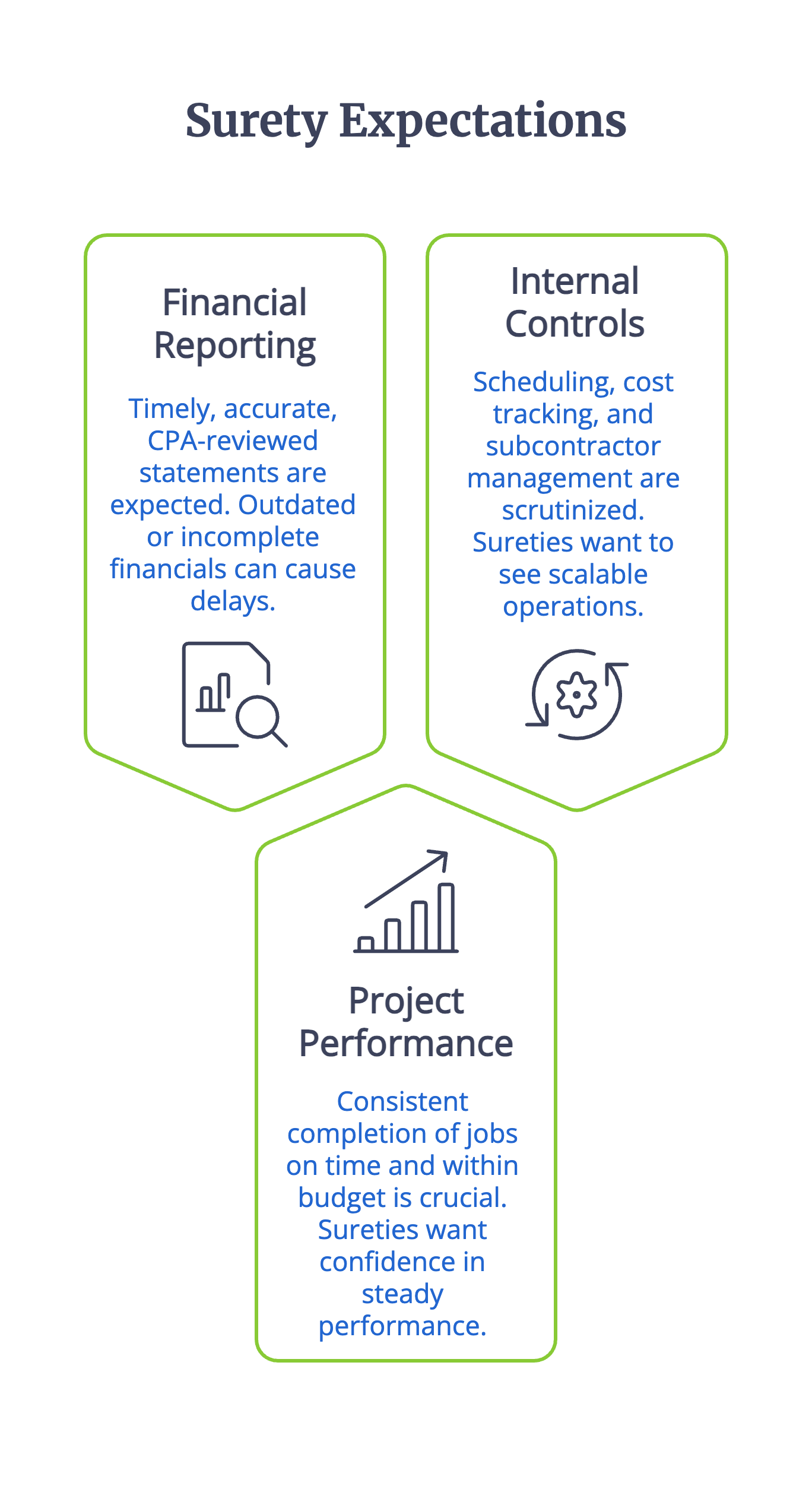

- Your financial reporting discipline

Sureties will expect timely, accurate, CPA-reviewed statements. In a busier environment, outdated, incomplete, or internally prepared financials can slow down approvals or raise concerns.

- Your project performance and history

Carriers will review whether you’re consistently completing jobs on time, on budget, and without major disputes. As backlogs expand, sureties want confidence that your performance remains steady—even under pressure.

- Your internal controls and operational processes

Scheduling, cost tracking, subcontractor management, and change-order processes will all come under greater scrutiny. Sureties want to see that your operations can scale with the increased volume of work expected in 2026.

For contractors, my advice is to begin strengthening your internal processes now, before underwriting scrutiny intensifies. This includes working with your CPA to produce timely quarterly or semiannual financials, closing out projects promptly and documenting performance, and improving cost-control and forecasting practices across your operations. It’s also important to ensure your accounting system can generate the reports your surety will need and to maintain open, proactive communication with your broker and carrier. Taking these steps early will position you for smoother approvals when competition increases.

Embrace Technology as Part of the Bonding Process

Surety has moved to the digital age with many bonds being electronically issued and signed by all relevant parties. This reduces clerical errors and cuts execution time considerably. Some sureties are also now connecting directly to contractors accounting systems using Quickbooks, Sage & Viewpoint, while automated and Ai enhanced underwriting allows the review and approval of many smaller commercial/transactional bonds.

In real terms, while technology doesn’t replace the need for strong financials and proven performance, it becomes especially important in 2026 because the volume and pace of work will increase at the same time underwriting standards become more thorough. Contractors will be competing for last-cycle IIJA projects, navigating tighter capacity, and responding to faster-moving bid schedules—meaning delays or administrative inefficiencies that were manageable in past years could now cost them opportunities.

Here are a few of the developments having the biggest impact:

- Electronic bond issuance and digital signatures

Electronic execution significantly reduces paperwork errors, speeds up delivery, and provides a more efficient process—especially helpful when timelines are tight.

- Direct integrations with contractor accounting systems

More carriers are connecting directly to platforms like QuickBooks, Sage, and Viewpoint, giving underwriters real-time access to accurate financial data. This reduces back-and-forth requests and helps streamline reviews.

- Automated and AI-enabled underwriting

For smaller or transactional bonds, automated underwriting platforms are becoming more common. These tools allow many approvals to be completed in minutes rather than days, reducing administrative delays for contractors who bond frequently.

I’d suggest that contractors start adopting digital processes now, before pressure builds. This means ensuring your accounting system is up to date and capable of integrating with surety platforms,using electronic bonds whenever possible, and improving data accuracy and internal recordkeeping. I truly believe that incorporating technology early on not only streamlines your workflow—it also signals to your surety partner that you run a modern, well-organized operation.

Look for Ways to Stay Competitive as a SMB

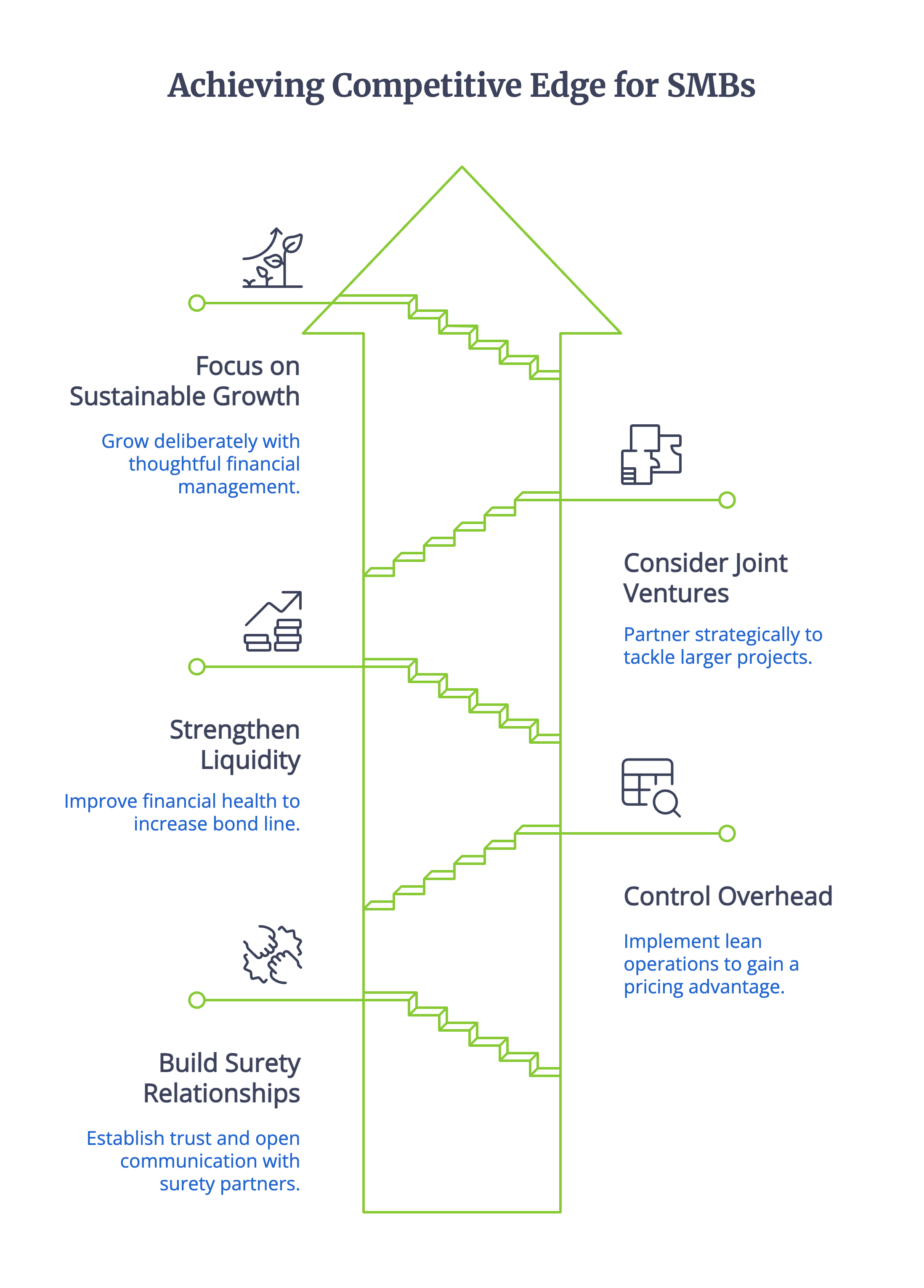

The upcoming infrastructure cycle may feel especially challenging for smaller contractors, but there are effective ways to remain competitive without taking on unnecessary risk. In a market where larger firms are pursuing more work and underwriting standards are tightening, smaller contractors can still position themselves well by focusing on fundamentals and demonstrating consistent operational discipline. The key here is in not trying to “look big”, but to operate efficently within both your and your surety partners comfort zone while continually trying to expand upon it.

Here are several approaches that can make a meaningful difference:

- Build strong relationships with your surety broker and carrier

Build strong relationships with your surety broker and surety carrier focusing not only on the balance sheet, but on a relationship of trust.

- Control overhead

Smaller contractors with lean operations can have an advantage over larger firms on pricing

- Strengthen liquidity gradually

Strengthen the liquidity on your balance sheet to earn incremental bond line increases.

- Consider joint ventures for larger opportunities

Forming joint ventures for a strategic partnership to share risk and qualify for larger projects than you would have on your own

Smaller contractors don’t need to grow aggressively to compete—they need to grow deliberately. Thoughtful financial management, open communication, and steady performance can significantly strengthen your surety support and position you well for 2026’s increased activity.

In real-world terms, SMBs should focus on clarity, discipline, and sustainable growth. When you operate efficiently and communicate proactively, your surety partner will be much more willing to support you as opportunities expand.

A Final Recommendation for 2026

If there’s one message I want contractors to carry into 2026, it’s this: your balance sheet is your competitive edge. Strengthen liquidity, preserve working capital, and reinforce the financial foundation that your surety relies on. Next year will move fast. The contractors who win will be the ones who prepared early, built trust with their surety partners, and entered the funding surge with the financial discipline to seize opportunity instead of chasing it.

At Lance, we’ve always believed that choosing the right surety partner early (one who grows with you and stands with you through cycles) is one of the most valuable long-term decisions a contractor can make.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.