Business Owners Reveal What They Get Wrong About Insurance

Running a business comes with risk and plenty of paperwork. But how well do business owners really understand the insurance policies they rely on? To find out, we surveyed 684 business owners across the U.S. We looked at their perceptions of risk, insurance habits, and willingness to consider alternatives like bonding. The results reveal a disconnect between what businesses fear, what they pay for, and what actually protects them.

Key Takeaways

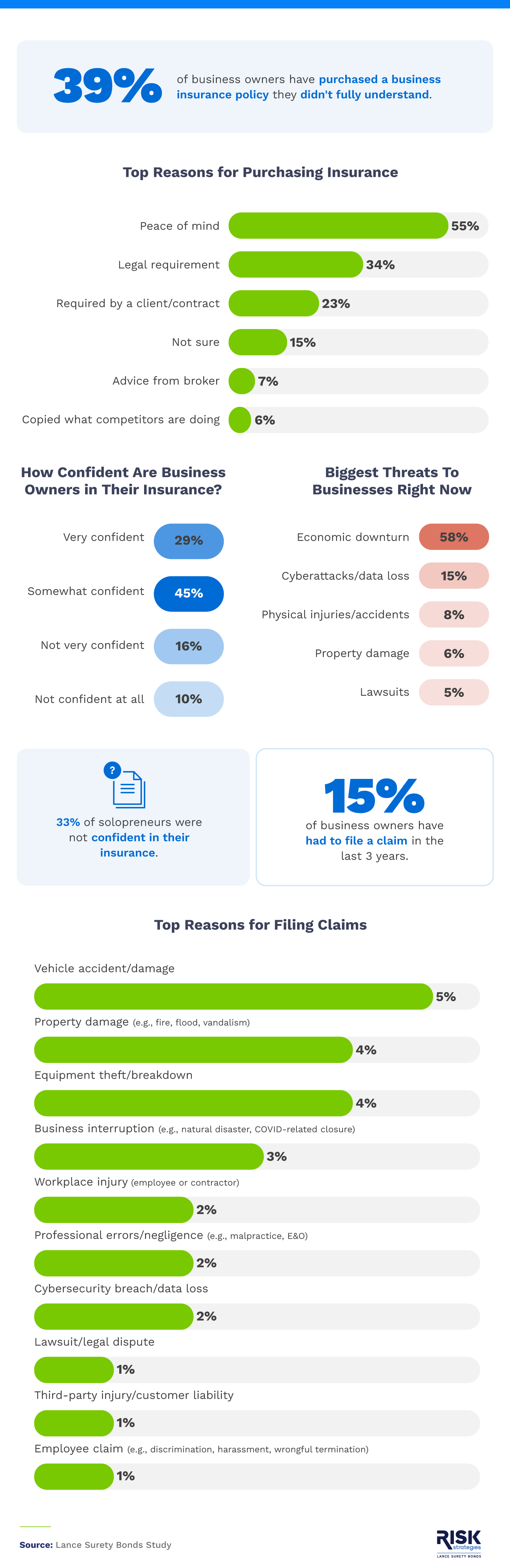

- 39% of business owners admit to purchasing a business insurance policy they didn't fully understand.

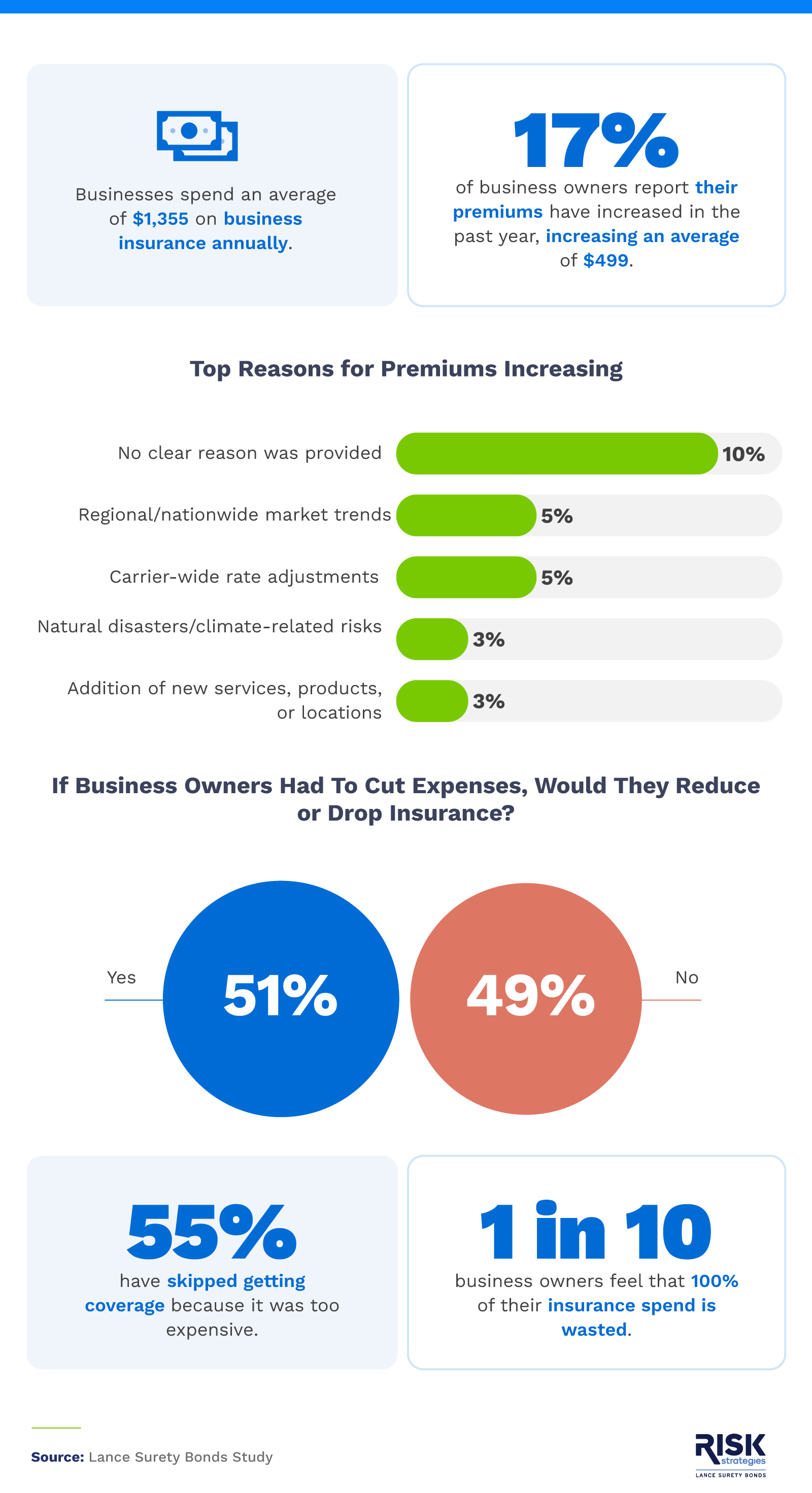

- 55% of business owners have skipped insurance because it was too expensive, and 1 in 10 believe their entire insurance spend is a waste.

- More than 1 in 2 business owners (51%) would reduce or drop insurance entirely if they needed to cut expenses.

- 38% of business owners would consider bonding if it meant better coverage or lower premiums.

- 11% of business owners accept crypto, but nearly half of them (49%) aren't covered, leaving revenue unprotected.

How Business Owners View, Use, and Misunderstand Insurance

Insurance decisions can be complex, and many business owners are navigating them without full confidence.

Insurance is essential, yet many owners feel unsure about navigating it. In fact, 39% overall admitted to purchasing a policy they didn't fully understand. A third of solopreneurs (self-employed individuals who run their business alone) also said they weren't confident about their coverage.

Despite these gaps in understanding, business owners still have strong opinions about what threatens their operations most. Economic downturns topped the list, cited by 58%, followed by cyberattacks at 15%. However, only 15% of owners have filed an insurance claim in the last three years, most often due to vehicle accidents or damage.

This gap between perceived threats and actual claims suggests many may be paying for coverage they rarely use, or, in some cases, may not know how to use effectively when the need arises.

The Cost of Coverage: High Premiums, Low Satisfaction

Rising premiums and unclear policy terms are fueling skepticism among business owners. Many question whether their coverage is worth the cost and whether they can afford to keep it.

On average, owners reported spending $1,355 per year on coverage. Seventeen percent reported premium increases, often without explanation, as 1 in 10 said they were never given a reason for the change. For some, especially those in regulated industries, business license bonds offer a more affordable way to meet legal requirements without overpaying for traditional insurance policies.

Frustration with pricing is also widespread. Over half of business owners (55%) have skipped coverage altogether because of high costs. When faced with tight budgets, 51% said they would reduce or drop their insurance entirely before cutting other expenses. Even more concerning: 1 in 10 believe their entire insurance spend is a waste.

Most Business Owners Haven't Explored Options Beyond Standard Insurance

When traditional insurance feels too costly or doesn't address every need, tools like bonding can help businesses meet specific legal or contractual requirements without adding unnecessary premiums. Yet most business owners aren't taking advantage of these solutions, even as their risks and compliance needs change.

Over three-quarters (76%) haven't considered options outside of standard insurance. This includes bonding, which remains unfamiliar to many small business owners. More than half (55%) admitted they don't know what bonding is, and only 5% have actually used it.

Bonding is the process of obtaining a surety bond, a three-party agreement between a business, a customer or government agency, and a surety company. The bond guarantees the business will fulfill certain obligations, such as complying with laws, delivering contracted work, or meeting licensing requirements.

While bonding doesn't replace insurance, it can sometimes lower overall costs by fulfilling specific requirements more affordably than an insurance policy would. Nearly 2 in 5 business owners (38%) said they would consider bonding if it led to reduced costs.

Shifts in business practices are also creating new vulnerabilities. Eleven percent of owners now accept cryptocurrency payments, yet nearly half of them (49%) lack protection against related losses. As revenue models evolve, so too must strategies for safeguarding assets.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

Rethinking Risk: Smarter Protection Starts With Better Awareness

The findings highlight a clear gap between what business owners fear, what they pay for, and what they actually understand. Making better risk decisions begins with understanding your options. Whether that means exploring bonding or reevaluating your current policy, now is the time to ensure your business is both cost-efficient and fully protected.

Methodology

We surveyed 684 U.S. business owners on July 24, 2025, to understand how they view risk, insurance, bonding, and alternative forms of coverage. Respondents represented a variety of industries and business sizes. The study reflects self-reported behaviors and perceptions at the time of the survey.

About Lance Surety Bonds

Lance Surety Bonds is a leading surety bond provider helping businesses across all 50 states meet their licensing, compliance, and financial security needs. Whether you're a first-time business owner or an experienced contractor, we offer fast, affordable bonding solutions, including license bonds, contract bonds, and more, tailored to your industry. Our experts make the bonding process easy, so you can focus on growing your business with confidence.

Fair Use Statement

You're welcome to share this study for noncommercial purposes. Please include a link back to this page and credit Lance Surety Bonds as the source.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.