How Business Owners Are Responding to Employee Theft in 2025

When you think of business threats, cyberattacks and economic shifts might come to mind first. But there's another risk quietly affecting companies across industries: internal employee theft. In 2025, this issue is more common than many realize.

One way businesses protect themselves from internal fraud is by purchasing an employee dishonesty bond. This type of surety bond provides coverage if an employee steals money, property, or other assets from the company. To understand how prepared businesses are, we surveyed 250 business owners about their awareness of these bonds, their experiences with employee theft, and how they've responded when trust was broken.

Key Takeaways

- 78% of business owners had never heard of an employee dishonesty bond before taking this survey.

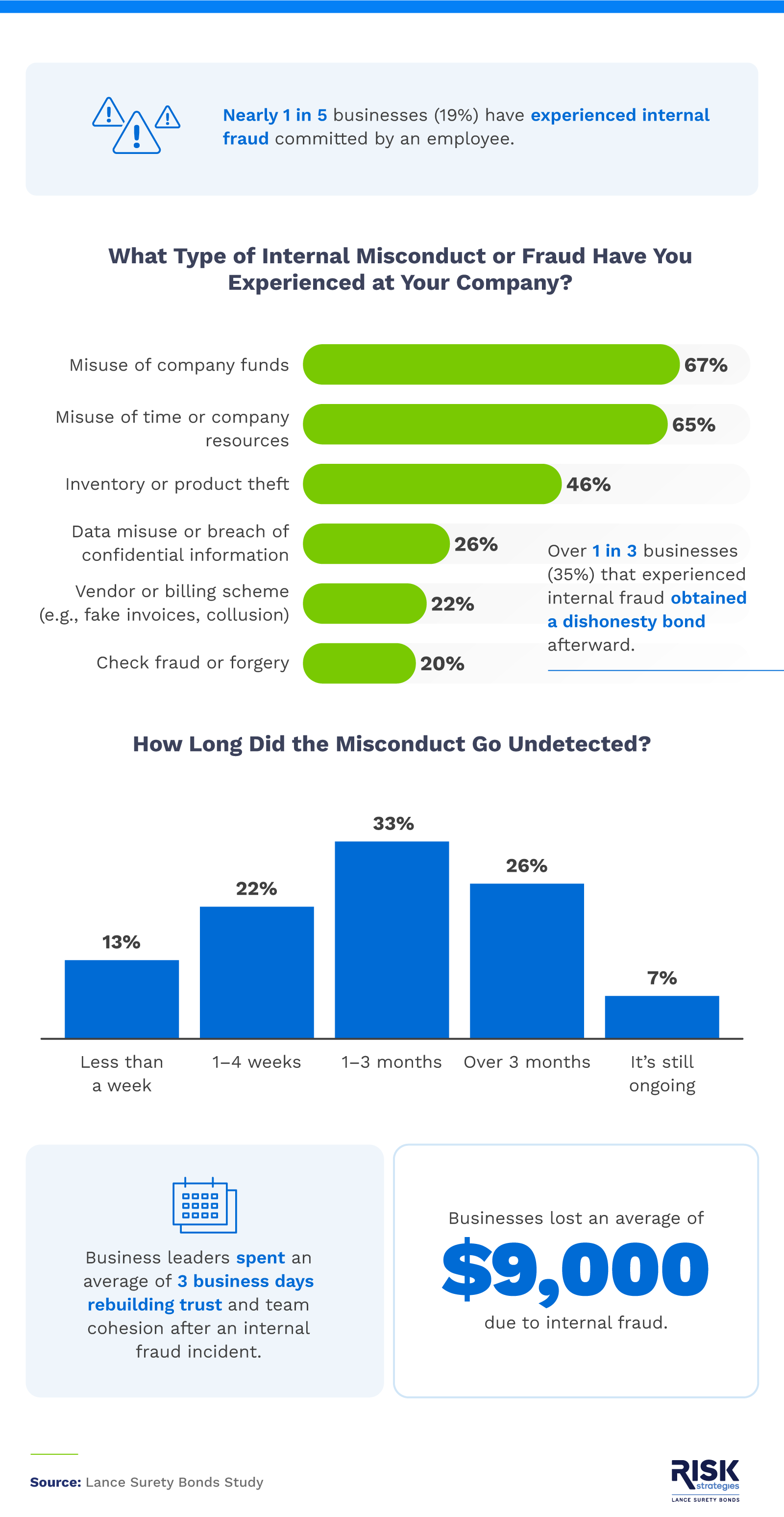

- Nearly 1 in 5 business owners (19%) say they've experienced internal fraud committed by an employee.

- Business leaders spent an average of 3 business days rebuilding trust and lost $9,000 per employee fraud incident.

- Most internal fraud cases (33%) go undetected for 1 to 3 months.

- 83% of businesses changed how they manage or monitor employees after experiencing fraud.

Get Your Free Bond Quote Today. 100% Secure and No Obligation!

Why Don't More Businesses Use Employee Dishonesty Bonds?

Many business owners still aren't aware of the tools that can protect them from internal threats.

A staggering 78% of businesses said they had never heard of an employee dishonesty bond before now and aren't currently protected by them. These bonds cover losses from employee theft, forgery, and fraud, but they're not yet widely adopted, largely due to a lack of awareness.

When asked for the top reasons why they don't have one, 32% said they weren't sure how the bonds work, and 27% didn't think their company was big enough to need one. Another 23% said they hadn't had an incident to justify it, while 22% completely trusted their employees not to steal from the company.

However, interest is growing. Over half of business owners (59%) said they'd be more likely to invest in a bond if they had a clearer understanding of what it covers. For those unsure about how these bonds compare to other types of protection, this guide on fidelity bonds vs. surety bonds breaks down the key differences.

Cost didn't seem to be a major barrier. On average, $750 per year was considered a fair price for a dishonesty bond. Seventeen percent were even willing to pay an annual price of $1,000 to $3,000.

Some industries are already ahead of the curve. Finance, manufacturing, and tech companies were the most likely to carry this kind of coverage.

The Real Impact of Internal Employee Fraud

When employee misconduct happens, the damage can be deeper than dollars and cents.

Nearly 1 in 5 business owners (19%) reported experiencing employee fraud. The most common types of internal misconduct included misuse of company funds (67%), misuse of time or company resources (65%), and inventory or product theft (46%). Data misuse and vendor/billing schemes were also reported.

These incidents don't just sting. They cost businesses an average of $9,000 per incident, with owners spending roughly three business days rebuilding trust and team morale. Even more concerning, 59% of these businesses had no financial protection, like insurance or a dishonesty bond, at the time of the incident.

Fraud incidents most often went unnoticed for one to three months. Businesses most often detected employee misconduct through these means:

- Manual audit: 46%

- Leadership personally noticed: 41%

- Whistleblower or tip from staff: 28%

- Vendor or partner raised concern: 22%

- Accidentally: 22%

The industries hardest hit by internal fraud were transportation, manufacturing, and healthcare, where complex operations and high employee turnover may contribute to greater risk.

How Businesses Are Responding to Employee Theft

Employee theft often triggers major changes in how companies operate.

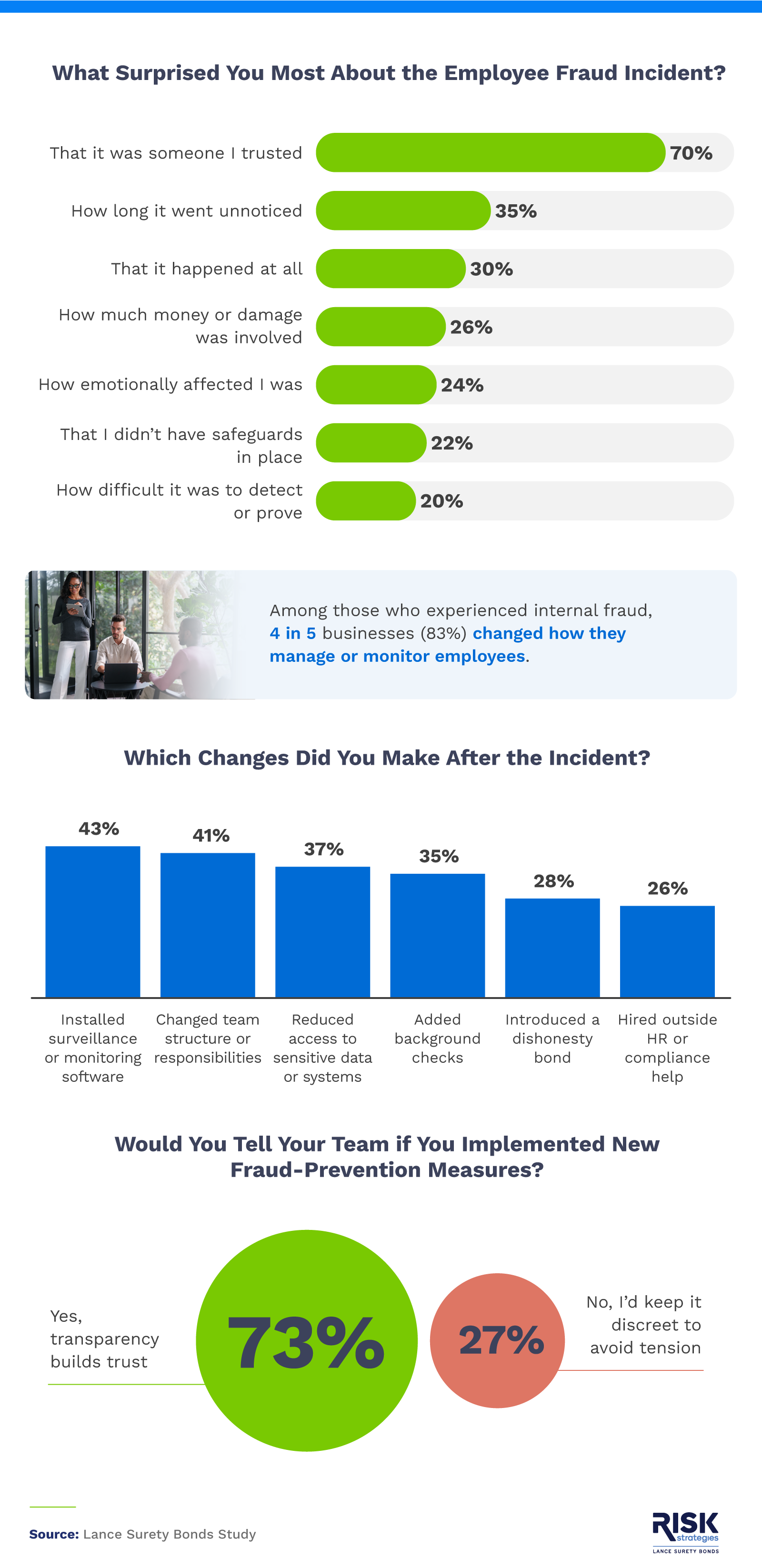

Of the businesses that experienced fraud, 83% made changes to how they manage or monitor staff. The emotional toll was significant, with 70% of business owners saying they were most surprised that the incident involved someone they trusted.

In response, companies implemented stronger safeguards. The most common steps included installing surveillance software (43%), changing team structures or responsibilities (41%), reducing access to sensitive data (37%), and adding background checks (35%). More than a quarter introduced an employee dishonesty bond (28%) or hired outside HR or compliance help (26%).

These incidents had a lasting effect on leadership styles. Half of business owners said they now trust and delegate less to their employees. Many also described strong emotional reactions, including feeling betrayed (67%), embarrassed (48%), anxious (30%), and isolated (26%).

Building Stronger Defenses Starts With Awareness

Employee theft might not make headlines like ransomware attacks, but it's quietly impacting businesses every day. Most incidents go undetected for months, cost thousands of dollars, and leave emotional scars on leadership.

But there's hope. As awareness increases, more companies will learn the steps they need to take to protect themselves. Understanding and using tools like employee dishonesty bonds can help businesses prevent future losses and rebuild confidence.

Methodology

We surveyed 250 American business owners to reveal the threat of internal employee fraud in 2025. The average age was 47; 45% were female, 54% were male, and 1% were non-binary. Generationally, 8% were baby boomers, 32% were Gen X, 48% were millennials, and 12% were Gen Z. The percentages in this study may not total 100 exactly because of rounding.

About Lance Surety Bonds

Lance Surety Bonds is a leading provider of surety bonds for professionals and businesses across the U.S. From contractor license bonds to employee dishonesty bonds, we help companies meet legal requirements and protect against financial loss. Our streamlined online process makes it easy to secure the coverage your business needs.

Fair Use Statement

We encourage you to share the insights from this article for noncommercial purposes. Please include a link back to Lance Surety Bonds with proper attribution.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.